While the SMA is slower to respond to the current market conditions of a stock, it guard you the trader from being faked out by a price spike. That is, the smoother SMA has a tendency to be a bit slower to respond to price movement and trends. Your other option the simple moving average has the opposite problem. EMA calculates an exponentially-weighted mean, giving more weight to recent.

SMA VS EMA SERIES

That is, the EMA could appear to be showing an upward trend beginning to form, when all that is really happened was a random spike in the stock’s price. SMA calculates the arithmetic mean of the series over the past n observations. Then, because of the choppy nature of the EMA, you may become faked out by false positives in the moving average. Act fast in finding a trend and you act fast in making money.Ī drawback to the EMA is it has a tendency to be a bit choppy compared to the SMA. When choosing a moving average that can react quickly to price changes and trends, then the exponential moving average is the one to choose. Traders can use both SMA and EMA to find out trends.

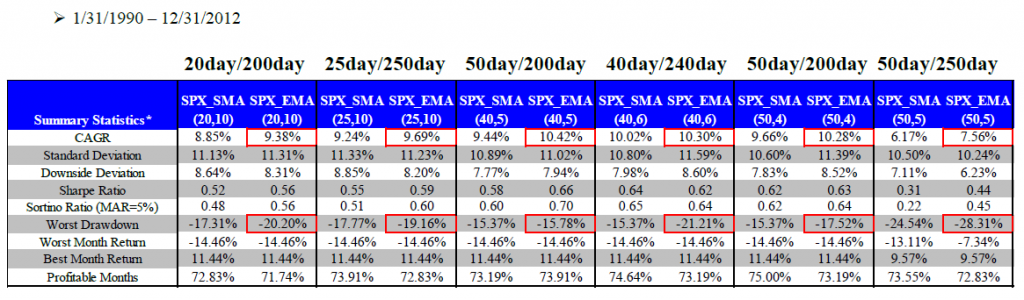

SMA vs EMA for Swing Trading As you know swing trading can last from weeks to 2 or 3 months. Similar is the case of EMA, however, the setting differs from the one done for SMA. Adding the SMA vs.Let us first summarize the exponential moving average. In the chart above, the smaller the SMA period, the higher is the sensitivity. EMA Exponential moving averages apply more weight to the most recent price data. SMA is calculated by summing up the price periods and this value is divided by the number of such periods. At the bottom of these notes is a link to a study done by trade station A Comparative Study of Moving Averages: Simple, Weighted and Exponential. While the faster reaction may get you into something sooner than with the SMA for instance however, you will also be whipsawed more often. The relationship between the SMA and EMA when they are both on equal inputs (in this case we used twenty (20) 30-minute time frames). Simple moving averages apply equal weight to the prices used to calculate the average. The SMA is the mean average of all closing prices within the given amount of days. Many traders seem to like EMA’s because they react faster. Some traders like using this combination as it shows the relationship between the general price action over a specific amount of time vs. In this case, the weight is added to the most recent price action through the “Smoothing Factor” which is shown in the figure below.Īs you can see, the equation for the “Exponential Moving Average” is much more complex than calculating the “Simple Moving Average” as it adds a level of complexity to give the more recent action more weight. The “Exponential Moving Average” is still a moving average that is plotted on the chart but is more sensitive to recent price action than the “Simple Moving Average”. for a 20-day moving average, you would add each of the last 20 closes and divide that number by 20, giving each close a 5% weight). In this case, every single close within the equation has equal weight (i.e. The “Simple Moving Average” is a slower indicator that has a mathematical formula that is simply the mean of closing prices over X period of time plotted on a chart. However, even though these can be very useful, especially as many traders become educated and are looking at the same thing creating self-fulfilling moves, there are other moving average relationships that backtest very well. When most traders think of moving average confirmation strategies, they may immediately think of the generic and most widely used ones such as the 50-day Simple Moving Average vs.

0 kommentar(er)

0 kommentar(er)